japan corporate tax rate 2018

Our company registration advisors in Japan can deliver more details related to the corporate tax in this country. And 31 March 2018 Tax rates for companies with stated capital of JPY 100 million or greater are as follows.

Real Estate Related Taxes And Fees In Japan

Japan corporate tax rate 2018.

. Corporation tax national Local corporate Tax. Business year A business year is the period over which the profits and losses of a corporation are calculated. Corporate income tax.

The tax rate for corporations other than SMEs is 234. Japan Corporate Tax Rate was 3062 in 2022. 2 New Brunswicks 2017 budget lowered the Small Business Income Tax Rate from 35 to 3 effective April 1 2017.

Taxation in Japan Preface. The penalty is imposed at 5 to 10 once the tax audit notice is received. Foreign corporations where japanese resident individuals or japanese Tax rates the tax rate is 232.

The contents reflect the information available up to. In addition interest for the late payment of tax is levied at 26 per annum for the first two months and increases to 89 per annum thereafter for the year 2020. Income from 400000001 and above.

The corporate tax rate in Japan for a branch is the same as for a subsidiary. The Tax tables below include the tax rates thresholds and allowances included in the United Kingdom Salary Calculator 2018 which is designed for salary calculation and comparison. The corporation tax rate unlike progressive income tax is determined by the type and size of the corporation.

2018 Corporation Tax Rate. Central government tax 3 190 255 255. After April 1 2019.

Income from 18000001 to 400000000. Income from 9000001 to 18000000. The Corporation Tax Rate in Japan.

Income from sources in Japan during each business year. The corporation tax rates and business allowances in the United Kingdom are updated annually with new tax tables published by HMRC. Principal business entities These are the joint stock company limited liability company partnership and branch of a foreign corporation.

Special local corporate tax rate is 4142 percent which is imposed on taxable income multiplied by the standard of. A major feature of corporation tax is the tax rate. The general corporate tax rate applies to active business income in excess of the business limit.

The main types of corporate income tax in Japan are as follows. When weighted by GDP the average statutory rate is 2544 percent. This page provides - Japan Corporate Tax Rate - actual values historical data forecast chart statistics economic.

Corporate income tax rate exclusive of. Japan Tax Profile Produced in conjunction with the KPMG Asia Pacific Tax Centre Updated. This booklet is intended to provide a general overview of the taxation system in Japan.

The 2020 Tax Reform Act reviewed the requirements for reporting of overseas property. Please note that the personal exemptions shown are for directional purposes personal exemptions for filers are calculated based on employment Income Deductions which are applied based on earnings. Tax rates The tax rate is 232.

The local standard corporate tax rate in Japan is 234 and it applies to normal companies with a share capital which exceeds JPY 100 million USD 896387. For a company with capital of 100 million or less a lower. Historical Chart by governors Haruhiko Kuroda.

The business year is stipulated by the companys articles of incorporation. The tax rates for corporate tax corporate inhabitant tax and enterprise tax on income tax burden on corporate income and per capita levy. A 19 corporate tax rate is applied for companies which had average incomes larger than 15 billion JPY in the preceding 3 years.

Taxable income 4 mln 8 mln 4 mln 8 mln. Corporate Tax Rate in Japan averaged 4083 percent from 1993 until 2021 reaching an all time high of 5240 percent in 1994 and a record low of 3062 percent in 2019. Tax notification must also be submitted when a foreign corporation generates income subject to corporate tax in Japan without establishing a branch office ie where 2 of 334 Table 3-5 applies.

A reconstruction surcharge of 255 applied in 2013 but does not apply after 1 April 2014The effective corporate tax rate taking into account the local enterprise tax and local inhabitant tax will therefore be reduced to 3564 previously 3801 from 1 April 2014. See also Corporate Taxation of Investment Income 1 NL NT NU and PE use the federal small business limit. Statutory Corporate Income Tax Rate in Japan as of April 2014 1.

2018 the corporate tax rate was changed from a tiered structure that staggered corporate tax rates based on company income to a flat rate of 21 for all companies. 232 for the fiscal year starting after April 2018. 1 If a company has capital in excess of 100 million Japanese yen or is a wholly owned subsidiary of a large corporation with capital of more than 500 million Japanese yen the company is treated as large corporation under corporate tax.

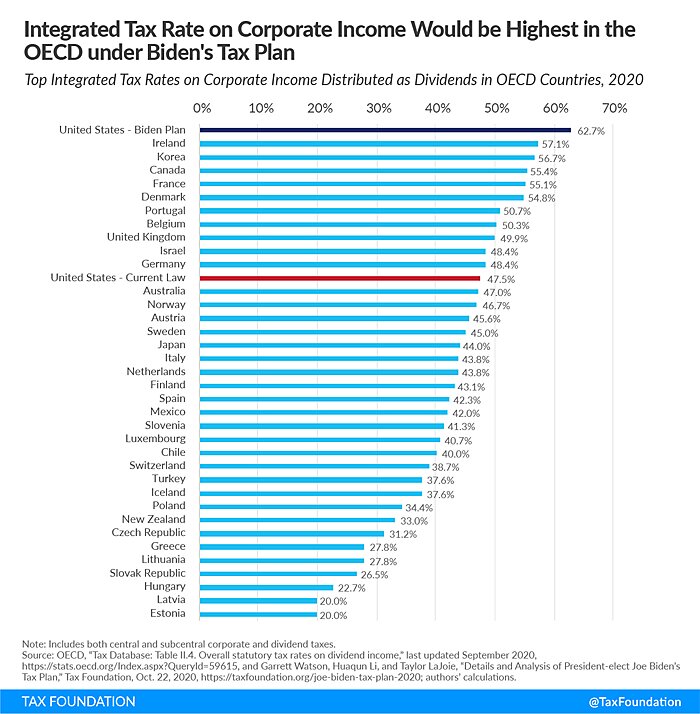

Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020. 10 rows Due to a provision in the recently enacted Tax Cuts and Jobs Act TCJA a corporation with a fiscal year that includes January 1 2018 will pay federal income tax using a blended tax rate and not the flat 21 percent tax rate under the TCJA that would generally apply to taxable years beginning after December 31 2017. Asia has the lowest regional average rate at 1962 percent while Africa has the highest regional average statutory rate at 2797 percent.

Rates Corporate income tax rate 232 30-34 including local taxes Branch tax rate 232 30-34 including local taxes Capital gains tax rate 232 30-34 including local taxes. 227 rows The worldwide average statutory corporate income tax rate measured across 180 jurisdictions is 2354 percent. Their Bill 23 November 2017 reduces the rate to 25.

Taxing Corporations Might Be Good Politics But It S Still Bad Policy Cato Institute

Japan National Tax Revenue Statista

Corporate Tax Remains A Key Revenue Source Despite Falling Rates Worldwide Oecd

Latvia Tax Income Taxes In Latvia Tax Foundation

Global Distribution Of Revenue Loss From Tax Avoidance Re Estimation And Country Results Eutax

日本 企业所得税税率 1993 2021 数据 2022 2024 预测

Canada Tax Income Taxes In Canada Tax Foundation

Corporate Tax Reform In The Wake Of The Pandemic Itep

Capital Gains Tax Japan Property Central

Latvia Tax Income Taxes In Latvia Tax Foundation

Corporate Tax Reform In The Wake Of The Pandemic Itep

Japan Tax Income Taxes In Japan Tax Foundation

Latvia Tax Income Taxes In Latvia Tax Foundation

Real Estate Related Taxes And Fees In Japan

Doing Business In The United States Federal Tax Issues Pwc

Lithuania Corporate Tax Rate 2022 Data 2023 Forecast 2006 2021 Historical

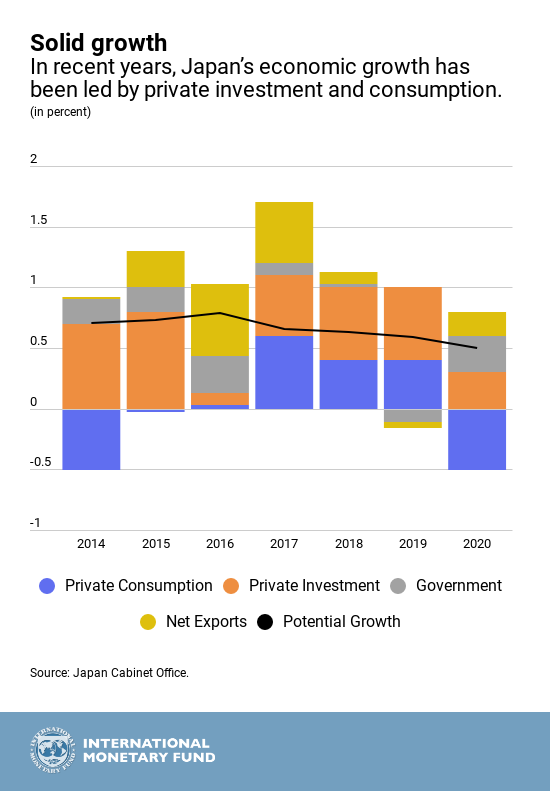

Japan S Economy In 5 Charts World Economic Forum

Israel Corporate Tax Rate 2022 Data 2023 Forecast 2000 2021 Historical Chart